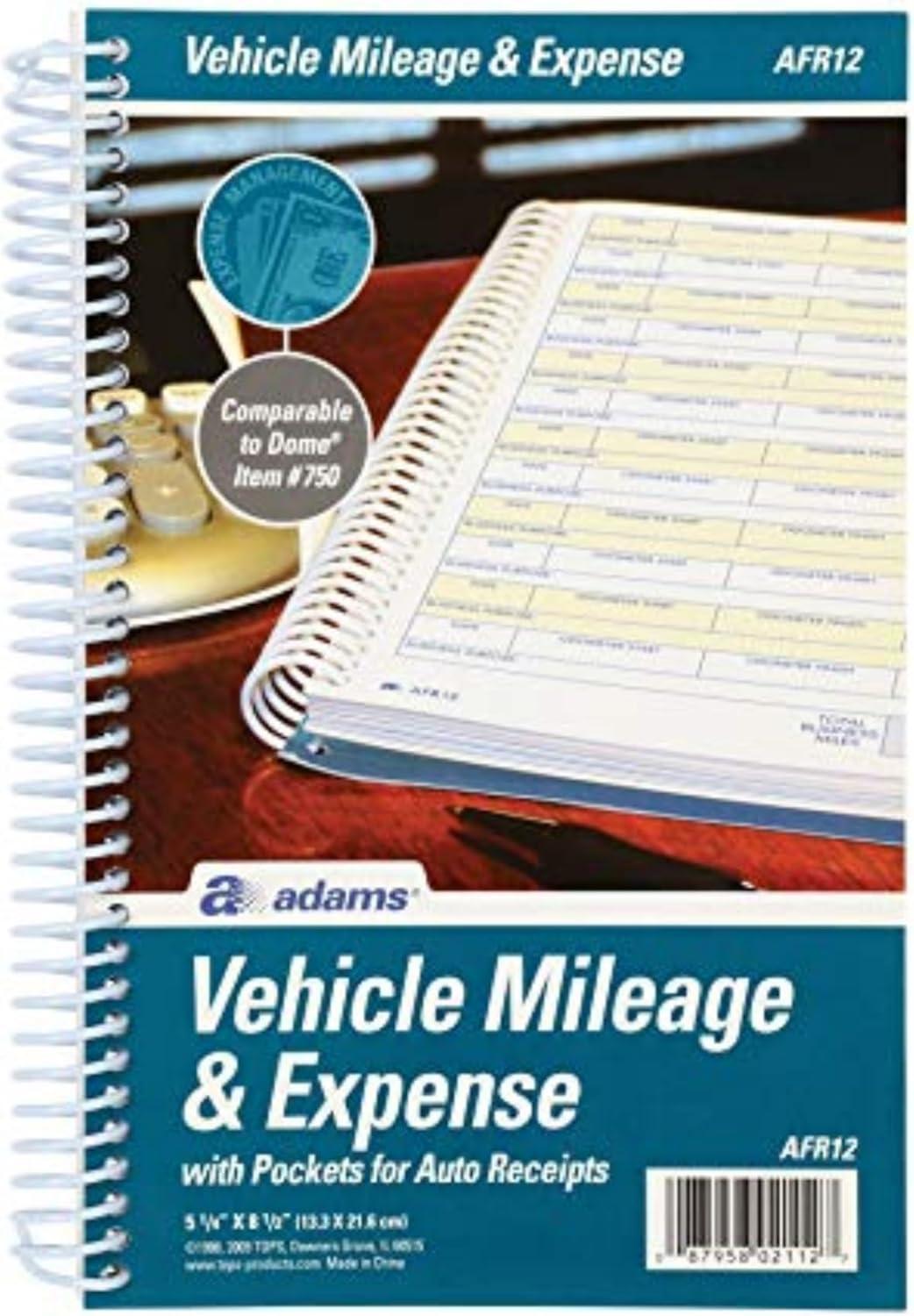

Our Experience with the Adams Mileage and Expense Journal

The Adams Vehicle Mileage and Expense Journal is a compact,spiral-bound book designed to fit seamlessly in your glove box. With 588 mileage entries, it allows me to easily log date, odometer readings, trip miles, and business purpose for each trip. The annual summary page helps me calculate monthly totals and determine my business-use percentage, which has been invaluable during tax season. The inclusion of six receipt pockets, two for service, two for repairs, and two for parking and tolls, ensures I keep all necessary documentation organized.

I particularly appreciate the dedicated pages for maintenance and repairs,as well as the four pages for tracking parking and tolls. The heavy cardstock cover has held up well in my car, resisting wear and tear. this journal has made it effortless to maintain meticulous records,ensuring I maximize my deductions and simplify tax filing.

| key Features | Pros | Cons |

|---|---|---|

| 588 Mileage Entries | generous space for year-long records | May require refilling for extended use |

| Six Receipt Pockets | Keeps receipts organized and secure | Could be more if additional categories are needed |

| Fits Glove Box | Portable and easily accessible | May not fit in smaller glove boxes |

| Annual Summary page | Facilitates deduction calculations | requires manual calculations for some users |

Discovering the Features That Resonate with Us

The Adams ABFAFR12 Vehicle Mileage and Expense Journal is a compact and durable solution for tracking business car usage.Measuring 5-1/4" x 8-1/2", it fits seamlessly into the glove box and is spiral bound for durability. With 588 mileage entries, users can log dates, odometer readings, trip miles, and business purposes effortlessly. The journal includes an annual summary page for calculating business use percentage, 6 pages for maintenance and repairs, and 4 pages for parking and tolls. It also features 6 receipt pockets—2 for service, 2 for repairs, and 2 for parking and tolls—ensuring all deductible expenses are recorded. The heavy cardstock cover withstands the rigors of daily use, making it an essential tool for tax season.

The 588 mileage logs provide ample space for tracking business trips throughout the year, and the annual summary page simplifies calculating the business use percentage for IRS reporting. The 6 receipt pockets are a standout feature, keeping critically important documentation organized and easily accessible. The journal’s portable size ensures it can be kept in the glove compartment at all times, promoting consistent record-keeping. however, some users may find the cover could be more water-resistant for frequent outdoor use.

Here’s a

| Feature | Pros | Cons |

|---|---|---|

| 588 Mileage Entries | Ample space for year-round tracking | Entries might be insufficient for high-mileage users |

| Annual Summary Page | Easy calculation of business use percentage | Page layout could be more detailed |

| 6 Receipt Pockets | Keeps receipts organized and safe | Pockets could be larger for more storage |

| Portable Size | Fits glove box easily; convenient for on-the-go use | Cover durability could be improved for harsh conditions |

Practical Insights and Our Journey with the Spiral Bound Design

the Adams ABFAFR12 Vehicle Mileage and Expense Journal is a compact and versatile tool designed for tracking business vehicle use. At 5-1/4" x 8-1/2", it fits perfectly in the glove box, making it easy to keep on hand. The journal includes 588 mileage entries, allowing me to record date, odometer start/finish, business miles, and purpose for each trip. An annual summary page helps calculate monthly totals and business use percentage, which is invaluable for tax season.I also appreciate the 6 receipt pockets dedicated to service, repairs, and parking/tolls, ensuring all deductible expenses are accounted for.

The spiral binding makes it durable and easy to use, while the heavy cardstock cover can withstand the rigors of daily car use. The 49 pages of mileage logs and additional sections for maintenance and tolls provide a extensive record of vehicle expenses. Keeping this journal in the glove compartment has made tracking business miles effortless and has simplified my tax planning process. The design is user-friendly, and the inclusion of receipt pockets prevents any important documentation from getting lost.

HereS a summary of it's key features, pros, and cons:

| adams Vehicle Mileage and Expense Journal Summary | |

|---|---|

| Features | 588 mileage entries, annual summary page, 6receipt pockets, 49 pages for mileage logs |

| Pros |

|

| Cons |

|

Real-World Recommendations for Tracking on the Go

I've been using the Adams Vehicle Mileage and Expense Journal in my daily commute for business, and it's been a game-changer. the 5-1/4" x 8-1/2" size fits perfectly in my glove box, and the spiral binding ensures it stays open while I record entries. With 588 mileage logs, I've never run out of space to track my trips, odometer readings, and business purpose. The annual summary page has made calculating my business-use percentage for tax time incredibly easy, and the 6 receipt pockets have kept all my documentation organized. The durable cardstock cover has held up well despite daily exposure to the elements.

The journal includes dedicated pages for maintenance and repairs, parking, and tolls, making it easy to categorize all my vehicle-related expenses. I love that it has 2 double-sided pockets for service receipts, 2 for repair receipts, and 2 for parking and tolls, ensuring I never misplace any important documentation. Keeping it in the car at all times has helped me stay meticulous with my records, which has saved me headaches during tax season.

Here’s a quick summary of its key features:

| Feature | details |

|---|---|

| Mileage Entries | 588 logs |

| Sizes | 5-1/4" x 8-1/2" |

| Design | Spiral bound, fits glove box |

| Receipt Pockets | 6 pockets (service, repair, parking & toll) |

| Pros |

|

| Cons |

|

Get yours today and make tax time a breeze!

Embody Excellence

Adams ABFAFR12 Vehicle Mileage and Expense Journal, 5-1/4" x 8-1/2", Fits the Glove Box, spiral Bound, 588 Mileage Entries, 6 Receipt Pockets,White

Maximize your deduction with 588 entries, 6 receipt pockets, and detailed trip logging.

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.