The Supernova Advisor: Crossing the Invisible Bridge to Exceptional Client Service and Consistent Growth

Designed to help financial professionals unlock lasting growth and enhance client relationships, this methodology leverages the 80/20 Rule to focus efforts where they'll deliver the most impact. By prioritizing high-value activities, such as cultivating key clients and streamlining time-consuming processes, it empowers advisors to boost revenue while maintaining exceptional service standards. Rooted in real-world experience from leading firms, including Merrill Lynch, this approach has proven to be a reliable tool for professionals seeking to scale their practices without sacrificing quality.Its practical strategies emphasize measurable outcomes, making it accessible for those ready to transform their workflows into more efficient, client-centric systems.

Thoughtfully structured as a guide for implementation, this resource provides actionable insights tailored to the financial services landscape.With a concise 127-page format and a clear, step-by-step narrative, it equips readers with tools to refine their client acquisition tactics, optimize service delivery, and strengthen their practice management. The author's expertise shines through in explaining how to balance client satisfaction with profitability, ensuring the framework remains adaptable to individual business needs. Published by John Wiley & Sons, Inc. in 2025, it serves as a foundational text for advisors looking to stay competitive in an evolving industry.

- Pros

- Proven effectiveness in boosting revenue and client satisfaction

- Actionable strategies for immediate request in practice

- Industry recognition from top financial institutions

- User-amiable structure with real-world examples

- Cons

- May require customization for diverse business models

- Complexity in initial setup for new advisors

- limited focus on digital tools or modern client trends

| Feature | Detail |

|---|---|

| Publisher | John Wiley & Sons, Inc. |

| Publication date | December 5, 2025 |

| Edition | 1st |

| Language | English |

| Print Length | 127 pages |

| ISBN-10 | 0470249277 |

| ISBN-13 | 978-0470249277 |

| Item Weight | 2.31 pounds |

| Dimensions | 6.1 x 0.9 x 9.1 inches |

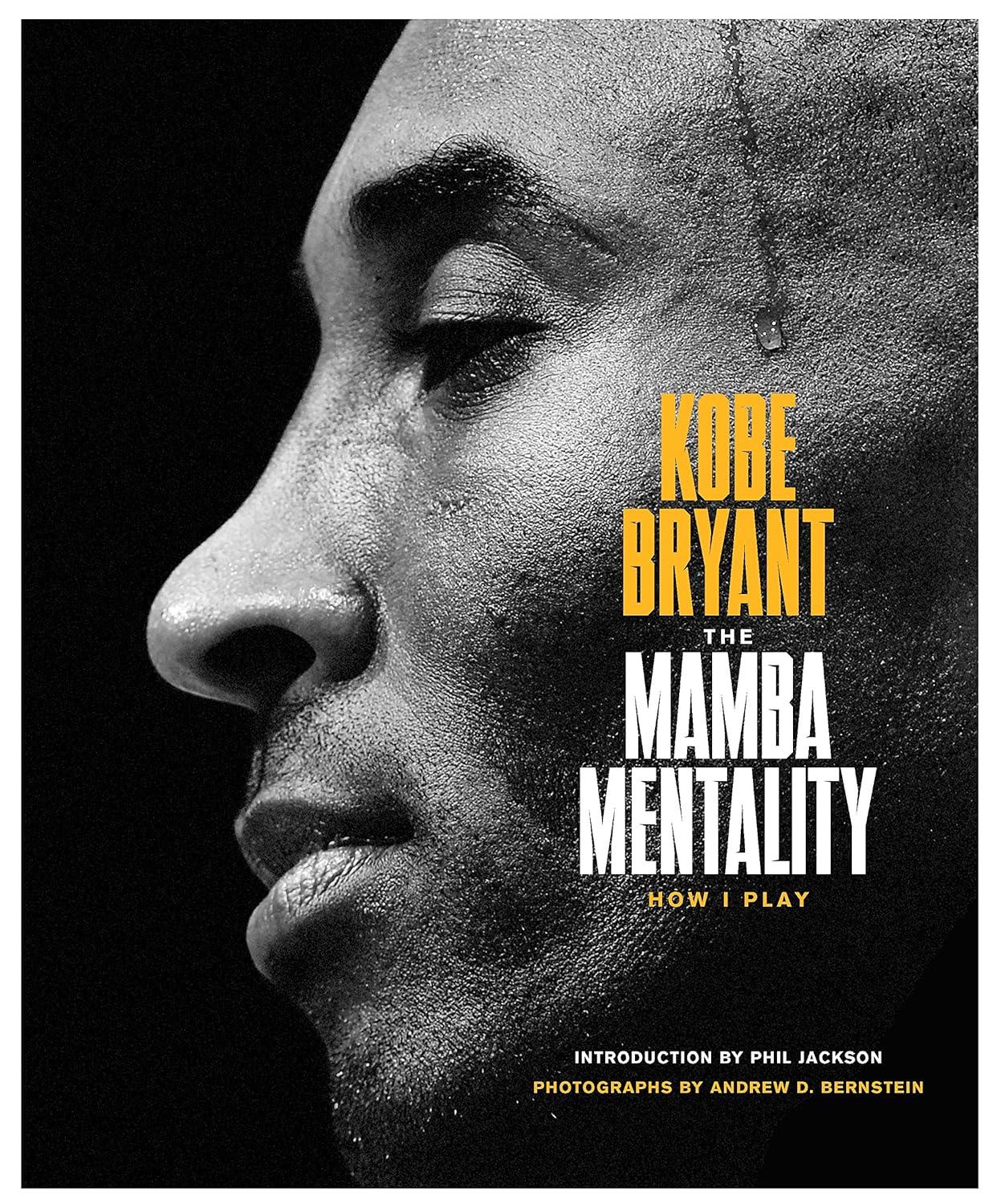

the Billionaire's Apprentice: The Rise of The indian-American Elite and The Fall of The Galleon Hedge Fund

Explore the untold story of how Indian-American entrepreneurs and leaders have carved their path from immigrant roots to the pinnacle of America's financial elite. This book delves into the dramatic rise of figures like Raj Rajaratnam, whose influence on Wall Street was once rivaled only by the Galleon Group-a hedge fund that managed billions before its downfall in a high-profile insider trading scandal. Through gripping narratives and deep research, it reveals the strategies, networks, and cultural dynamics that propelled this community into positions of power, offering readers a rare glimpse into the hidden blueprint of modern business success. Whether you're fascinated by the intersection of culture and finance or want to understand the forces shaping today's corporate landscape, this account provides invaluable insights into a transformative journey.

Author Anita Raghavan weaves together a tapestry of global perspectives, from the boardrooms of New York to the corridors of India's prestigious institutions, to uncover the complexities of this influential group. The book is celebrated for its meticulous detail, vivid storytelling, and exploration of both triumph and controversy, shedding light on the ethical dilemmas and societal impact of these business leaders. With a blend of ancient context and contemporary relevance, it challenges readers to rethink the traditional pathways to power, while also highlighting the unique challenges faced by immigrant communities navigating the American dream. A must-read for those seeking to understand the evolving face of global capitalism.

- Pros

- Comprehensive coverage of Indian-American business hegemony and its historical roots

- Insightful analysis of high-stakes cases impacting corporate and financial systems

- Engaging blend of global and local narratives with real-world examples

- Detailed research and accessible writing style suitable for both casual readers and professionals

- Examines the cultural and societal shifts shaping modern business ecosystems

- Cons

- Intense focus on legal and ethical controversies may overshadow broader themes

- Dense content could be overwhelming for readers unfamiliar with financial jargon

- Some may find the tone of the "mafia" descriptor controversial or dismissive

- Limited exploration of non-financial sectors within the Indian-American community

| Feature | Detail |

|---|---|

| Author | Anita Raghavan |

| Themes | Cultural assimilation, corporate power, ethical boundaries |

| Scope | Global perspective: Wall Street to Indian Institutes of Technology |

| Insight | Examines immigrant success, financial networks, and societal impact |

The Great american Dividend Machine: How an Outsider Became the Undisputed Champ of Wall Street

Bill Spetrino's journey from a humble accountant to a financially secure investor offers a blueprint for those seeking stability and growth in the markets. Over two decades ago, he stumbled upon a simple yet powerful strategy that prioritizes income over speculation, leading to consistent returns and a net worth exceeding $5 million. His insights, now distilled into a practical guide, focus on building a portfolio of dividend-paying stocks that are inherently safe and reliable. Unlike the high-stakes, fast-paced approach of many traders, bill's method emphasizes patience and long-term value, making it accessible for everyday investors aiming to secure their financial future without unnecessary risk. By sharing his expertise through a newsletter hailed as the #1 low-risk investment letter, he has helped countless readers navigate the complexities of the stock market with confidence.

At the heart of Bill's approach are stocks with strong, enduring businesses, recognizable brand names, and resilient financial foundations. He identifies companies with competitive advantages that allow them to thrive in both good and bad economic conditions, ensuring dividends remain stable even during market downturns. His unique vetting process filters out speculative risks, focusing instead on businesses with significant capital reserves and clean balance sheets-key factors for long-term sustainability. This method, rooted in real-world experience rather than fleeting trends, empowers readers to create a reliable income stream while avoiding the pitfalls of Wall Street's volatile strategies. The book's straightforward guidance and actionable steps make it a valuable tool for anyone looking to build wealth through disciplined, dividend-driven investing.

- Proven strategies for long-term wealth building

- Focus on low-risk, dividend-paying stocks

- Emphasis on stability and simplicity over complexity

- practical, step-by-step approach for everyday investors

- Real-world examples of financial success

cons

- Requires time and patience to see results

- May not suit aggressive investment styles

- Dependent on market conditions and company fundamentals

- Limited focus on growth-oriented opportunities

- Not a one-size-fits-all solution for all investors

| Author | Bill spetrino |

|---|---|

| Publication Date | February 10, 2025 |

| Language | English |

| Pages | 208 |

| ISBN-10 | 1630060348 |

| ISBN-13 | 978-1630060343 |

| Dimensions | 5.9 x 0.6 x 9.1 inches |

Discover the Power

From the strategies of The Supernova Advisor to the cautionary tale of Galleon's downfall and the disciplined approach of The Great American Dividend Machine, the landscape of investment wisdom reveals clear paths toward success. Whether its the power of exceptional client service, the lessons from elite networks, or the simplicity of dividend-focused investing, each book underscores the importance of patience, research, and a commitment to long-term value. In a world where Wall Street's shortcuts frequently enough lead to pitfalls, these works offer readers the tools to build wealth, mitigate risk, and achieve financial freedom through tested principles and real-life triumphs.

the Supernova Advisor: Crossing the Invisible Bridge to Exceptional Client Service and Consistent Growth

Transforms client satisfaction into a competitive edge, blending personalized service with strategies for sustainable wealth building.

The Billionaire's Apprentice: The Rise of The Indian-american Elite and The Fall of The Galleon Hedge Fund

Exposes the risks of aggressive speculation versus the safe, systematic rise of a new financial class through accountability and long-term vision.

The Great American Dividend Machine: How an Outsider Became the Undisputed Champ of wall Street

Delivers a proven method to build wealth by investing in stable, high-yield stocks-proven to outperform the chaos of stock trading.